Personal Cover

Personal Cover

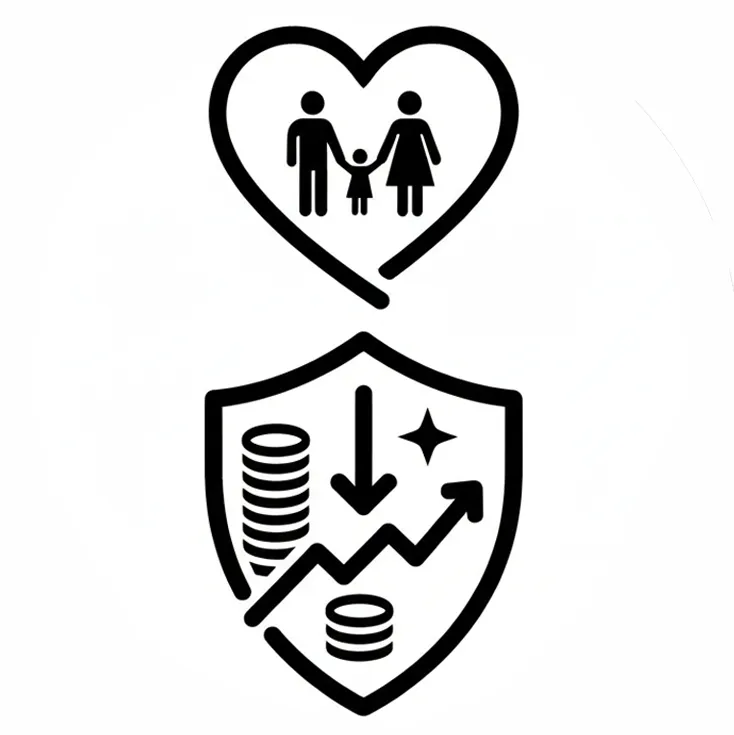

Personal Cover is a plan for the worst. We hope that you never need to use it, but should an issue arise, you will be glad you had it. Personal Cover is designed to protect you and your family in your time of need. There are different types of Personal Cover which may be relevant for you. Contact us and we can help advise on which types of cover are right for you.

Personal Cover is a small premium to pay to have peace of mind knowing your family is protected from whatever life may throw at you.

Life Cover

Although it isn’t always a pleasant topic it’s important to look at life cover. In the event of death or terminal illness your family can receive one of two benefits depending on their needs.

Your family may be paid a lump sum; to pay debts, cover funeral costs, give themselves financial breathing space, or whatever they may require the extra money for at this difficult time. The purpose of these funds is entirely up to you to decide.

Alternatively, the benefit can be paid out in monthly installments. This would allow your family to maintain a regular income, financial security and some stability after you’re gone.

In NZ.

1 in 6 men and 1 in 9 women will die between the ages of 30 and 65

STATISTICS NEW ZEALAND 2004

Although it isn’t always a pleasant topic it’s important to look at life cover. In the event of death or terminal illness your family can receive one of two benefits depending on their needs.

Your family may be paid a lump sum; to pay debts, cover funeral costs, give themselves financial breathing space, or whatever they may require the extra money for at this difficult time. The purpose of these funds is entirely up to you to decide.

Alternatively, the benefit can be paid out in monthly installments. This would allow your family to maintain a regular income, financial security and some stability after you’re gone.

In NZ.

1 in 6 men and 1 in 9 women will die between the ages of 30 and 65

STATISTICS NEW ZEALAND 2004

Critical Illness

In the event that you may be diagnosed with a critical illness, your insurance benefit can provide you with a lump sum payment to give you the support to focus on getting better.

Critical illnesses such as heart attack, cancer, or stroke are covered.

You can use your lump sum payment for things such as medical care, extended time off work, home modifications, or anything you may see necessary at that time.

In NZ.

40% of people will experience a Critical Illness before age 65

STATISTICS NEW ZEALAND 2004

In the event that you may be diagnosed with a critical illness, your insurance benefit can provide you with a lump sum payment to give you the support to focus on getting better.

Critical illnesses such as heart attack, cancer, or stroke are covered.

You can use your lump sum payment for things such as medical care, extended time off work, home modifications, or anything you may see necessary at that time.

In NZ.

40% of people will experience a Critical Illness before age 65

STATISTICS NEW ZEALAND 2004

Total and Permanent Disablement

Should an incident arise where you lose the ability to ever return to work due to illness or injury, your benefit would provide a lump sum designed to alleviate the impact of losing an income forever. Again, you may choose to use the lump sum as you see appropriate, but this could contribute to; paying down a mortgage, paying for home modifications or specialized equipment.

In NZ.

Stroke is the 3rd biggest killer and the greatest cause of disability

STATISTICS NEW ZEALAND 2004

Should an incident arise where you lose the ability to ever return to work due to illness or injury, your benefit would provide a lump sum designed to alleviate the impact of losing an income forever. Again, you may choose to use the lump sum as you see appropriate, but this could contribute to; paying down a mortgage, paying for home modifications or specialized equipment.

In NZ.

Stroke is the 3rd biggest killer and the greatest cause of disability

STATISTICS NEW ZEALAND 2004

Income Protection

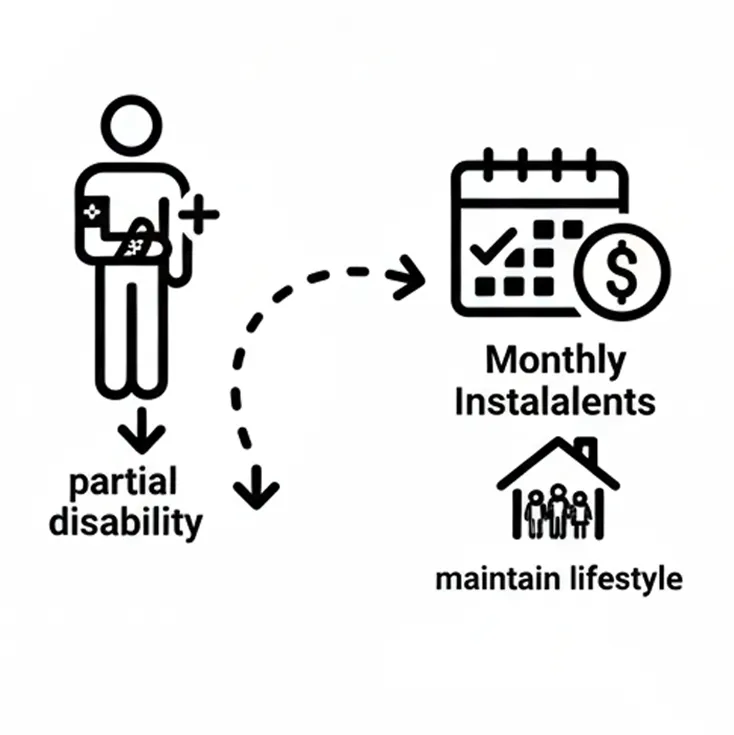

In the event of total or partial disability that would impair your earning potential, income protection insurance can replace a large portion of your lost income. This is different from Total and Permanent Disability insurance in that you are paid monthly rather than in one lump sum.

This will allow you and your family to maintain the lifestyle you had previous to the illness or injury.

In NZ.

5 out of every 10 males and 7 out of every 10 females are likely to become disabled due to an accident or illness before they turn 65

STATISTICS NEW ZEALAND 2004

In the event of total or partial disability that would impair your earning potential, income protection insurance can replace a large portion of your lost income. This is different from Total and Permanent Disability insurance in that you are paid monthly rather than in one lump sum.

This will allow you and your family to maintain the lifestyle you had previous to the illness or injury.

In NZ.

5 out of every 10 males and 7 out of every 10 females are likely to become disabled due to an accident or illness before they turn 65

STATISTICS NEW ZEALAND 2004

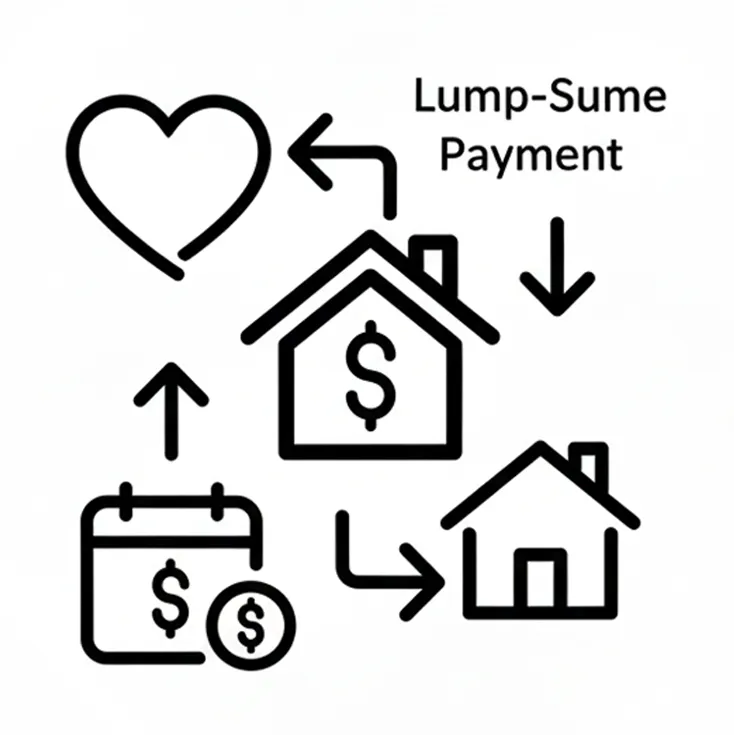

Mortgage Protection

Traditionally this benefit covers your monthly mortgage repayment should you be unable to work due to suffering an illness or accident. However, you can also have a lump sum paid to clear the mortgage in the event of death, total and permanent disablement or on suffering a critical illness.

In NZ.

Every 90 minutes a New Zealander dies from a heart attack (17 deaths a day)

STATISTICS NEW ZEALAND 2004

Traditionally this benefit covers your monthly mortgage repayment should you be unable to work due to suffering an illness or accident. However, you can also have a lump sum paid to clear the mortgage in the event of death, total and permanent disablement or on suffering a critical illness.

In NZ.

Every 90 minutes a New Zealander dies from a heart attack (17 deaths a day)

STATISTICS NEW ZEALAND 2004

Medical Cover

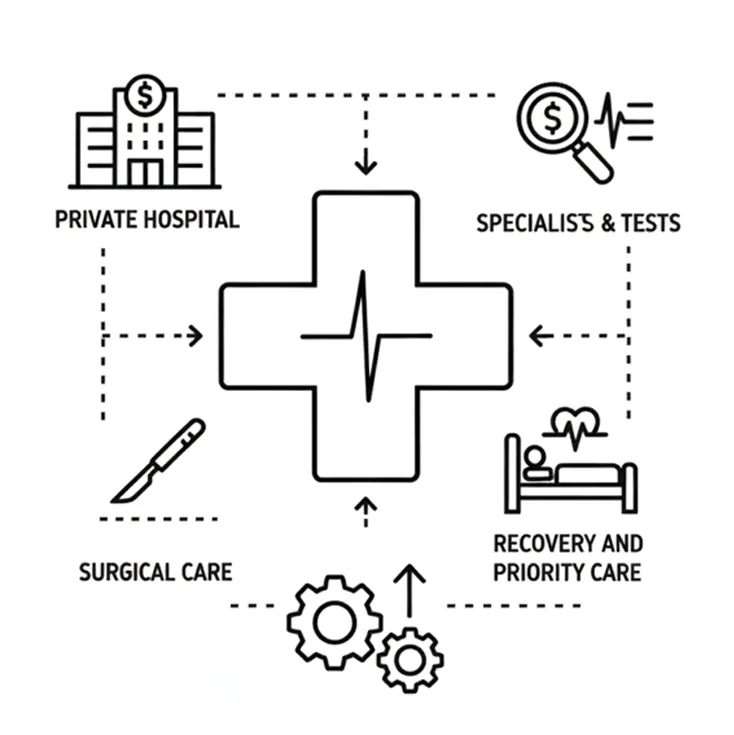

Medical Cover is designed to help pay for medical costs that will allow you to access services beyond what is publicly available. This can include priority care, access to private hospital treatment, high levels of surgical and non-surgical cover, specialists and test coverage, and increased care to help you recover. The level of coverage you have can be tailored to your needs and specifications.

In NZ.

Ill health or lack of health insurance is one of the 3 main causes of people going bankrupt

STATISTICS NEW ZEALAND 2004

Medical Cover is designed to help pay for medical costs that will allow you to access services beyond what is publicly available. This can include priority care, access to private hospital treatment, high levels of surgical and non-surgical cover, specialists and test coverage, and increased care to help you recover. The level of coverage you have can be tailored to your needs and specifications.

In NZ.

Ill health or lack of health insurance is one of the 3 main causes of people going bankrupt

STATISTICS NEW ZEALAND 2004

Premium Cover

Should you suffer a total or partial disability lasting longer than the chosen waiting period, this benefit covers the cost of your premium during your treatment and recovery. Making insurance premiums one less thing to worry about while you work on recovering.

Should you suffer a total or partial disability lasting longer than the chosen waiting period, this benefit covers the cost of your premium during your treatment and recovery. Making insurance premiums one less thing to worry about while you work on recovering.

If this all seems a bit overwhelming, don’t worry! We can help you through this so you can fully understand the different insurance types and those that might be relevant to your current circumstances.

Understanding insurance premiums to save money

© 2021 Rix Insurance Advisers Limited. All rights reserved.